Many business owners focus solely on revenue, but it’s important to remember that cash flow is king.

This means that even though a company may have high revenue, it’ll need more cash to pay bills or make necessary purchases.

Revenue is the amount of money a company earns from selling its products and services. A company’s cash flow is its net cash moving in and out.

Entrepreneurs should focus on learning about the cash vs revenue difference when evaluating the financial health of their business.

Managing cash flow is crucial for businesses with high-ticket offers that require more upfront cash.

While these two concepts are closely related, they aren’t the same. Understanding revenue and cash is critical to managing a successful business.

In this article, we’ll explore the cash vs revenue difference, look at profit vs free cash flow, and dive into how to manage both for long-term success.

Cash vs Revenue: A Primary Business Focus

Financial metrics such as cash flow vs revenue vs profit are used to evaluate the financial health of a business. These terms are important to understand (especially the difference between the words).

It’s easy to focus on just one metric to measure the success of your business, but that can be dangerous. Cash flow vs gross revenue, both are critical and need to be in balance.

Many businesses have fallen into the trap of focusing too much on revenue and needing more on cash flow, or vice versa.

Let’s see what happens when a business focuses on one aspect of financial metrics, which leads to imbalance:

Having Too Much Cash

When a business has more cash vs revenue difference, it means that the business is generating more cash than it is bringing in through revenue. The business can draw on its cash reserves or investments to cover expenses, but the issue is that it isn’t generating enough revenue to sustain itself.

Cash flow is generally good, but too much cash flow without enough revenue can cause problems.

Many businesses fail to put their cash to good use, such as expanding their operations or investing in growth opportunities.

They may not be pricing their offers correctly, they might over-invest in non-essential expenses. Businesses must balance their cash vs revenue difference to ensure long-term sustainability.

Having Too Much Revenue

When a business has more revenue than cash flow, it brings in more money than it has available to pay expenses.

Businesses may not be able to pay their bills, which can lead to late fees or penalties. That will harm the business’s credit rating. Investing in inventory, equipment, and employee salaries, could negatively affect operations if there’s no cash flow to back it up.

They may not be able to take advantage of new opportunities because they don’t have the cash on hand. This can lead to missed instances of potential growth and expansion.

Cash flow issues can result in stagnant growth, a lack of meeting financial obligations, and, eventually, a business failure.

Cash Flow Vs Net Income: Understanding The Money Language

In B2B (business-to-business) transactions, understanding the “money language” is critical for successful negotiations. Bascially, it’s the terminology and concepts related to financial transactions.

- Payment Terms: Common payment terms include “net 30,” “net 60,” and “net 90,” which indicate that payment is due within 30, 60, or 90 days after the invoice date. “COD” (cash on delivery) or “prepaid,” may also be used. Understanding these terms and being able to negotiate them is crucial in managing cash flow and ensuring that your business is paid on time.

- Gross Margin: It is the difference between a product’s cost and its selling price, expressed as a percentage. Understanding how to calculate and analyze gross margins is essential for determining a product’s or service’s profitability and setting prices that will allow your business to be profitable.

- Financial Metrics: These include Return on Investment (ROI) and Net Present Value (NPV). They can help evaluate a business’s financial performance and make informed investments.

Cash vs Revenue: What is More Important?

Cash flow and revenue are important for a business’s overall health and sustainability. However, they serve different purposes and have different impacts on a business.

Cash flow is a business’s cash to pay bills and make investments. A business must have enough cash flow to meet its financial obligations and grab new opportunities. Without enough cash flow, a business can miss opportunities, get hit with late fees and penalties, and ultimately fail.

On the other hand, revenue is the money a business brings in through sales or other means. It’s the primary source of income for a business, and it’s necessary to cover expenses and make a profit.

But, a business can have high revenue but low profits if it has high expenses or unprofitable sales.

Let’s dig deeper into why these two metrics, cash vs revenue, are important in a B2B business.

Reasons Why Revenue Is Important

Revenue is vital in B2B (business-to-business) transactions for several reasons:

- Primary source of income: Without revenue, a business cannot cover its expenses or generate profits.

- Measure growth: It is a key metric used to track the development and performance of a business over time.

- Evaluate the financial performance: It helps determine a business’s profitability. It is also used to make informed decisions during investments, partnerships, and other business ventures.

- Benchmark for pricing: By understanding the revenue generated by similar products or services, a business can set competitive prices to make it profitable.

- Performance indicator: Investors use revenue figures to decide whether to invest in a company.

- Measure success of sales tactics: Revenue is also important in the B2B sales process. It allows you to measure the effectiveness of sales strategies and tactics and make necessary adjustments for better results.

Reasons Why Cash Is Important

Cash is important in B2B (business-to-business) transactions for several reasons:

- Meet financial obligations: A business needs to have enough cash to pay bills, salaries, and make investments.

- Identifying new opportunities: A business with a positive cash flow can quickly take advantage of new opportunities. This includes making a strategic acquisition or investing in new projects.

- Building relationships: A business that can meet its financial obligations on time is more likely to be viewed as a reliable and trustworthy partner.

- Evaluate the financial health of a business: It is a key metric used to track the financial stability of a business over time.

- Ensure liquidity: Revenue ensures liquidity which is the ability of a business to meet its financial obligations as they come due.

- Negotiations: Cash flow allows businesses to take advantage of discounts for early payments and negotiate better payment terms with suppliers.

Cash vs Revenue: The Differences

Cash and revenue are two of the most important things to keep an eye on when running a business. Understanding the difference between the two is crucial for the success of your business.

Below are some key points for cash vs revenue difference:

| Revenue | Cash Flow | |

| Financial statement | Income Statement | Cash Flow Statement |

| Measuring properties | The amount of money a business brings in from its sales or services through marketing or other activities. | The money that a business generates from its day-to-day operations, investments, and financial activities. |

| Meaning | A healthy business must always have more revenue than expenses. | To remain profitable, the company’s cash flow must always remain positive. |

| Accounting based on accruals or cash | Revenue is reported based on when sales are made, not when payment is received. It is recorded when a deal is made, even if the payment has not yet been received. | Cash flow is reported based on the actual cash that moves in and out of business. It includes cash from operations, investments, and financing activities. |

The main cash vs revenue difference is the financial statement on which they are reported. Revenue is reported as the top-line number of the income statement and represents the total sales made during the accounting period. After all, expenses are subtracted, the net income is arrived at, which is the bottom-line figure on the income statement.

On the other hand, cash flow is the cash generated by the company’s operating, investing, and financing activities:

- Operating Cash Flow: Changes in current asset and current liability accounts.

- Investing Cash Flow: Changes in the firm’s investment account.

- Financing Cash Flow: Changes in long-term liability and equity accounts.

Net cash flow results from the addition and subtraction of accounts from the top-line net income figure, which is taken directly from the income statement.

Cash vs Revenue: Case Study Example

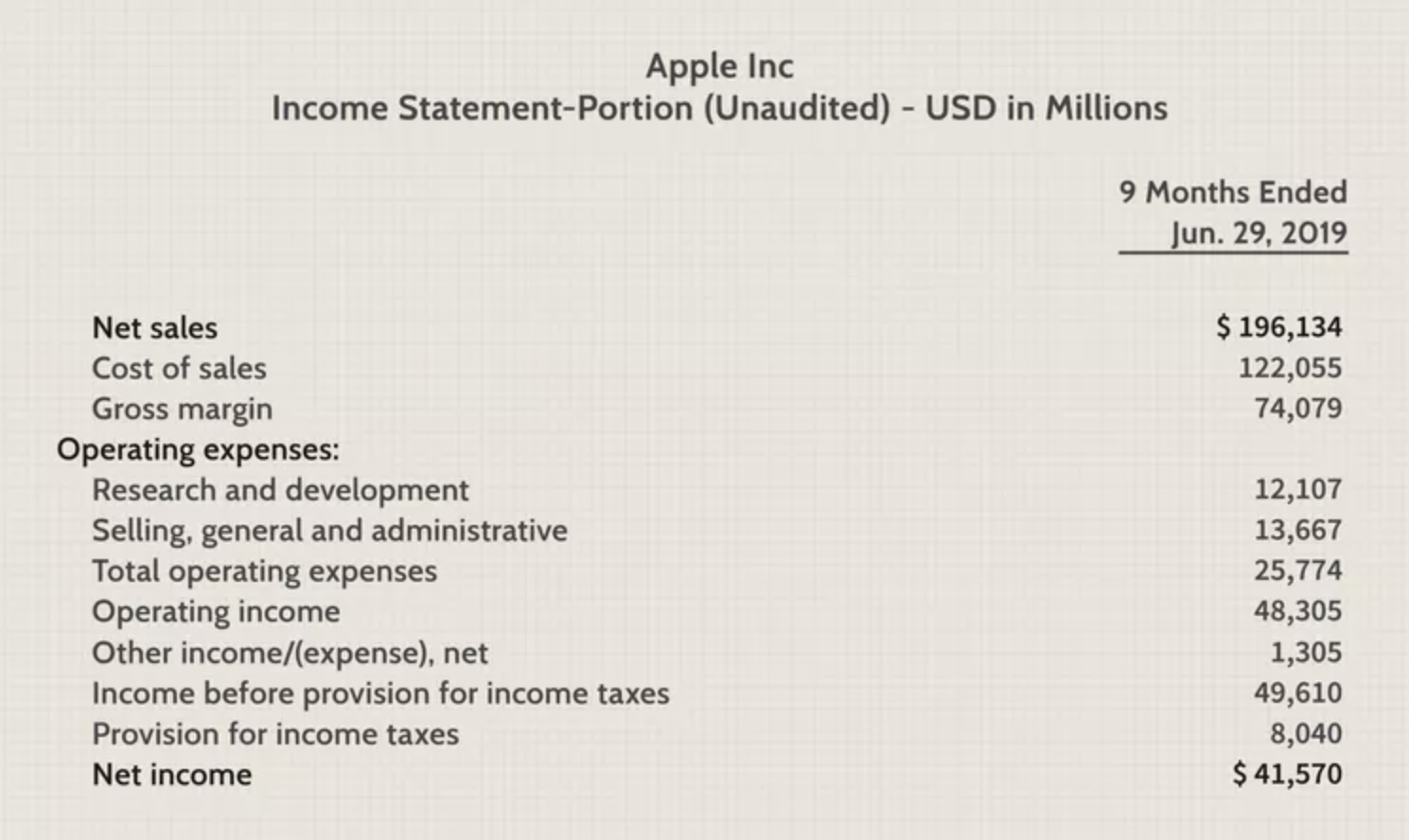

Let’s take the example of Apple Inc.’s income and cash flow statements, as reported in its 10Q on June 29, 2019:

For the period, net sales (revenue) were $196 billion. Since Apple typically has merchandise returns, its revenue figures are reported as net sales.

The income statement shows a net income of $41.5 billion.

Each item listed is either added to or subtracted from revenue (the top line) to arrive at net income (the bottom line).

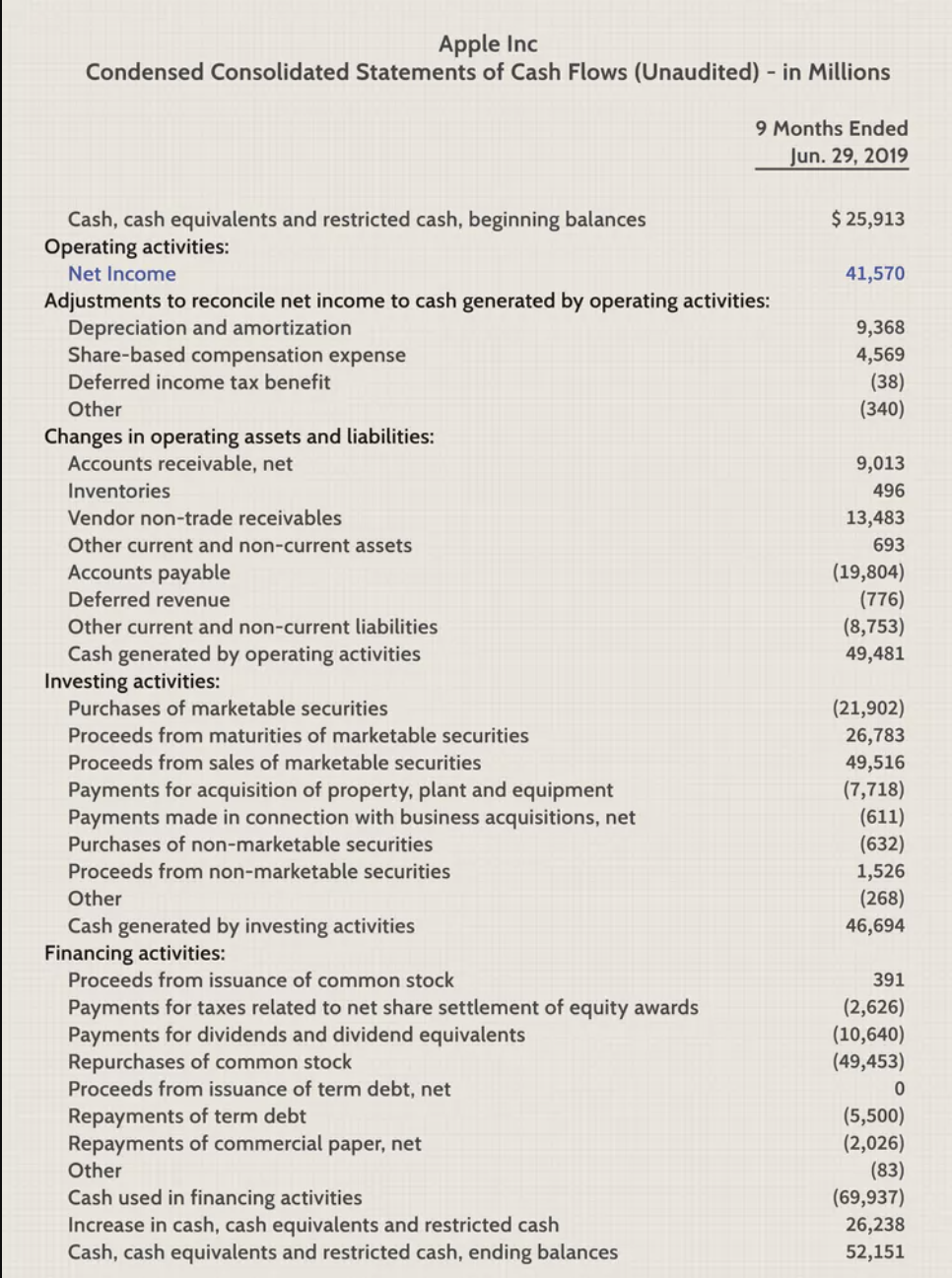

Below is Apple Inc.’s cash flow statement:

The net income figure of $41.5 billion is carried over from the income statement and added to cash and cash equivalents to establish the CFS starting point.

Blue highlights indicate the statement’s operating, investing, and financing sections.

All inflows and outflows are netted at the bottom of the CFS, resulting in a cash position of $52 billion.

Taking on new debt would increase cash flow but would not affect revenue. Conversely, a company could generate a lot of revenue but experience a cash crunch due to high operating costs.

Plus, companies with substantial debt payments often need more cash flow despite having high revenue. To fully evaluate a company’s financial health, cash vs revenue difference should be analyzed together.

Cash Revenue vs Revenue: FAQs

What is the cash vs revenue difference?

Cash flow is the cash generated by a company’s operating, investing, and financing activities. It is the actual cash coming into and going out of the business. Revenue is the total amount of money a company earns from its sales or services. It’s reported on the top-line number of the income statement and is before any expenses are subtracted.

Why is cash flow important?

Cash flow is important because it determines a company’s ability to pay its bills, invest in growth, and meet its financial obligations. A positive cash flow means a company has enough cash to cover its expenses and invest in the future. A negative cash flow means a company may struggle to pay its bills and survive in the long run.

Does revenue recognition affect cash flow?

Unearned revenue does not directly affect the cash flow statement. As a current liability, the fluctuation of its balance from year to year will influence the value of the operating activities on the financial statements.

Wrapping Up: Cash vs Revenue Difference

Cash flow vs gross revenue are critical financial metrics for any business, but they are significant in a B2B market. Cash flow refers to the amount of cash a company has available at any time.

Revenue is the amount of money a business brings in through its operations. Both cash flow and revenue are essential as they can indicate the company’s overall financial health.

It’s crucial for a B2B business to carefully manage both cash flow and revenue to ensure long-term financial stability and growth.At Scaling with Systems, we’ve helped thousands of business owners create a balance between their cash flow and revenue generated to succeed in the long run. We build profitable client acquisition systems to help you generate qualified leads on autopilot. Want a custom roadmap to help you scale your business this year? Book a free consultation call with our team today.